Litter Boxes

Modkat Flip

Front-Entry Litter Box

Modkat XL

Front/Top-Entry Litter Box

Modkat

Top-Entry Litter Box

Modkat Tray

Open Litter Box

Starter Kits

Essentials

Litter Keeper

Two colors

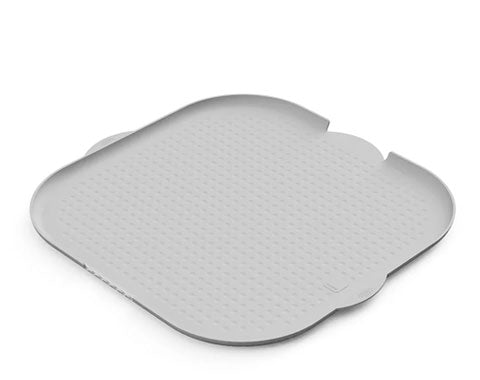

Litter Mats

Multiple styles, colors & sizes

Tidy-Up Kit

Scoop holder & dustpan

Lounge + Play

Scratchers & toys

Refills

Add description, images, menus and links to your mega menu

A column with no settings can be used as a spacer

Link to your collections, sales and even external links

Add up to five columns

Add description, images, menus and links to your mega menu

A column with no settings can be used as a spacer

Link to your collections, sales and even external links

Add up to five columns

Cat health insurance: common questions and answers.

Health insurance for pets is a relatively new product in the insurance marketplace. But for many pet owners, it’s a smart means of protecting your pet and achieving peace of mind in the process.

But pet insurance doesn’t come easily. Here are the top details you need to know when considering cat health insurance for your fur baby.

Understanding cat health insurance.

Technically, animal health insurance has existed since the 1890s when insurance agencies began to underwrite the healthcare costs for livestock such as horses and cows. It took nearly a century before agencies began to apply the same concept to small pets like dogs and cats. When they did, the concept took off. By 2022, more than 5.36 million dogs and cats had health insurance.

What is Cat Health Insurance?

Like health insurance for humans, cat health insurance helps cover medical care for your cat. As the pet's owner, you pay into your plan on a monthly or annual basis to receive benefits. Then when you visit your vet for preventative care, the cost of your appointment is partially or fully covered by the insurance carrier.

Coverage and benefits.

Cat health insurance plans can help pay for a series of illnesses and injuries, and the benefits vary from plan to plan.

Most pet health insurance covers treatment designed to address hereditary and congenital conditions, chronic conditions, and behavioral issues. You may also purchase supplements that help pay for microchipping, alternative therapies, medication, or prescription food.

Types of cat health insurance plans.

Generally speaking, pet health insurance plans for cats fall into one of three types: accident-only, routine care, or accident-and-wellness.

Accident-only plans do just what their name suggests — they cover accidents. If your cat swallows a foreign object, falls from an open window, or gets into a toxic substance, these plans can pay for emergency treatment.

Routine care plans help pay the cost of regular vet visits, often including flea-and-tick treatment, immunizations, and a wellness check. Some plans may also cover the price of spaying or neutering your pet.

Accident-and-wellness plans insure your pet for both accident and routine treatment.

Common questions about cat health insurance.

- How Much Does Cat Health Insurance Cost?

In June 2024, Marketwatch reported that the average cost of cat health insurance was $32 per month — about half the cost of insuring a dog. Prices varied by state, with Arkansas, Kentucky, Louisiana, North Dakota, and West Virginia being the cheapest. Costs also fluctuated widely among breeds and insurance providers. In this assessment, Figo offered the cheapest rates, while Trupanion was the most expensive. - What Does Cat Health Insurance Cover?

Each plan is different. Some pet health insurance plans cover all forms of accidents and illnesses, from bee stings to thyroid disorders. Others only pay for specific things like hospitalizations, cosmetic procedures, or routine care. - Are Pre-Existing Conditions Covered?

It depends on your carrier and your plan. Most of the time, incurable pre-existing conditions, such as cancer, diabetes, and kidney disease, are not covered by insurance. Pre-existing curable conditions, however, like ear infections or diarrhea, probably will be covered. - How Does Reimbursement Work?

Many cat health insurance plans work on a reimbursement model. You choose an annual deductible, usually in the amount of $100, $250, or $500. After you meet that deductible, your insurer reimburses you for a percentage of your pet's healthcare expenses.

Example:

Let's say you choose a plan with a $250 deductible and 70% coverage with a $2,500 spending limit. Here's how the process would work:

You pay for the first $250 of your cat's cost plus the price of insurance. For every dollar you spend above your $250 deductible, your insurer will reimburse you 70 cents until you spend $2,500. Then, you pick up the remainder.

Once you get into the details, you start to realize that pet health insurance can either be a financial buoy in a sea of pricey vet treatments or just an expensive line item in your budget.

Mandy, a 43-year-old pet lover who bought health insurance for her pet, Bingley, paid $80 a month on a $900-deductible plan with Nationwide. When Bingley's kidney values suddenly plummeted, the vet's office conducted ultrasounds and other high-dollar exams.

Nationwide covered none of these costs because crystals had been discovered in Bingley's urine prior to Mandy purchasing the policy. Eventually, she swapped out her costly pet insurance for a concierge care plan with a vet's office.

Another pet-lover, Lisa, however, had a different experience with Nationwide's pet benefits. Lisa's plan reimbursed her for a percentage of all her pets' general welfare visits, along with specialist and emergency coverage — at about the same price as Mandy's policy. Choosing the right plan is important if you want to make pet health insurance pay off.

Choosing the right cat health insurance plan.

When searching for the best pet health insurance for cats, you have a lot of options. How do you choose the best plan?

5 Factors to consider when choosing a pet health insurance plan.

1. Coverage options

Types of Coverage: What is covered? Are accidents? Routine care? Emergency visits? What about hereditary conditions?

Exclusions: Check for any exclusions in the policy, such as pre-existing conditions or certain cat breeds.

Coverage Limits: Understand annual, lifetime, or per-incident limits on payouts.

2. Cost

Premiums: Evaluate the monthly or annual cost of cat health insurance.

Deductibles: Consider the amount you need to pay out-of-pocket before the insurance starts to cover expenses.

Reimbursement Levels: Look at the percentage of the vet bill that the insurance will cover after the deductible is met.

Copays: Be sure to include any copayment requirements in your budget calculations.

3. Claim process

Ease of Filing: Check how easy it is to file a claim, whether it can be done online or requires extensive paperwork.

Claim Payout Time: Research how quickly claims are processed and paid out. Sometimes, you can see other pet owners' experiences on sites like Yelp or Reddit.

Direct Pay to Vet: Some plans offer direct payment to the veterinarian, which can simplify the process.

4. Provider network

Vet Choice: Confirm whether you can use any licensed veterinarian or if you are restricted to a network of providers.

Specialist Access: Ensure that specialists and emergency care providers are covered under the plan.

5. Reputation and customer service

Company Reputation: Research the insurance company's reputation, including reviews and ratings from other pet owners.

Customer Service: Evaluate the quality and availability of customer service, including response times and the helpfulness of representatives.

Experience and Stability: Consider the company’s experience in the pet insurance market and its financial stability.

Comparison of different cat health insurance plans.

At least 17 major companies offer cat health insurance plans, and one-third of Fortune 500 companies provide pet policies as employee benefits. Some of the most popular plans are listed below.

We do not recommend any single company, but we want to offer you this simple comparison as a place to start your research into the best cat health insurance options available.

5 Top pet health insurance companies.

Pets Best: Available in all 50 states, 24/7 pet helpline, Accident-only and accident-and-illness plans available, Customizable

Spot: Available in all 50 states, Unlimited annual coverage available, Accident-only and two wellness reward plans, Customizable

Lemonade: Available in 37 states, 5% multi-pet discount, One plan, Lots of customization and add-on options

Trupanion: Available in all 50 states, Can pay vets directly instead of reimbursing you, Multiple policies available, Customizable

ASPCA: Available in all 50 states, Very low cost, Accident-only and accident-and-illness plans available, Customizable premiums

Tips for maximizing cat health insurance.

Keeping up with preventative care is part of having a happy and healthy cat. It's also one of the best ways to maximize your pet's health insurance policy. Regular veterinary visits can prevent illnesses and catch chronic diseases early when they can be more easily controlled.

As a rule of thumb, kittens should see the vet every 3-4 weeks, adult cats once a year, and senior cats every six months. Of course, you should always follow your feline-friendly vet's advice about how often to schedule your pet's appointments.

Understanding policy terms and conditions is another way to help limit cat health insurance costs. If you know what your policy covers — and what it doesn't — you won't be in for any unpleasant and unexpected surprises later on.

The best pet health insurance for cats: reviews and recommendations.

Many ranking sites provide snapshots and evaluations of the best pet health insurance for cats, including Forbes, NerdWallet, U.S. News & World Report, USA Today, MarketWatch, CNN, and Consumer Reports.

We recommend perusing several of these advice sites along with the websites from which they drew their information. It's also a good idea to look at customer satisfaction and reviews on Google and other review sites. And you can always ask for input from other cat lovers on sites like Quora or Reddit.

Finally, talk to your vet about what carriers and policies, if any, they recommend to help your cat — and your budget — stay healthy and happy for a long time to come.

Keep your cat healthy and happy with Modkat litter boxes.

“It looks nicer than any other hooded or open option we considered.”

Categories

Meow from Brooklyn.

Sign up and get early access to product drops, exclusive offers, and the occasional cat meme.

Similar products related to this blog:

"It looks nicer than any other hooded or open option we considered."

"This litter box keeps everything in, nothing gets out the sides."

"My beautiful ragdoll cat and I both love the new Modkat Litter tray!"